Taxpayers Tax base Tax calculation Tax exemption Tax preferences 6-7. Corporative Income Tax. - ppt download

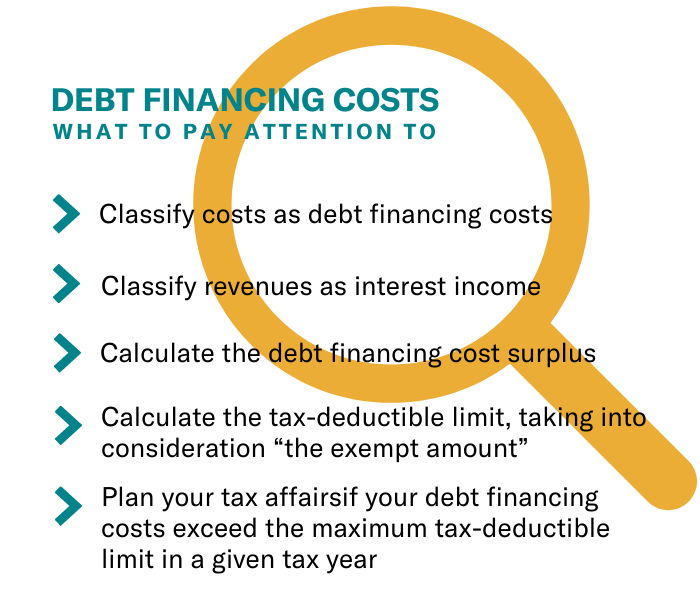

Threshold on deductible interest expense of enterprises with related party transactions for CIT calculation - KHAI MINH CONSULTING COMPANY, LTD

1 Speaker Name: André Marius Le Prince Company:WLP GmbH, Hamburg, Germany WIRA AG, Munich, Stuttgart, Düsseldorf, Nurnberg, Hamburg, Germany Phone: ppt download

Calculation of radial and vertical forces on the CIT 1. 75 m vacuum vessel for several TSC disruption scenarios - UNT Digital Library

![Diagnostics | Free Full-Text | A Novel Automatic Approach for Calculation of the Specific Binding Ratio in [I-123]FP-CIT SPECT Diagnostics | Free Full-Text | A Novel Automatic Approach for Calculation of the Specific Binding Ratio in [I-123]FP-CIT SPECT](https://www.mdpi.com/diagnostics/diagnostics-10-00289/article_deploy/html/images/diagnostics-10-00289-g001-550.jpg)

![Solved 3. \( [15 \mathrm{pts}] \) 군 Hand Calculation | Chegg.com Solved 3. \( [15 \mathrm{pts}] \) 군 Hand Calculation | Chegg.com](https://media.cheggcdn.com/study/0fb/0fb9469f-cf31-48bb-8ed0-0a29fd14be8e/image)